FAQ

Answered as of March 22, 2024

The Company serves as an importer and distributor for furniture, decorative products and fitness equipment from leading luxury brands. The company prioritizes selecting products and delivering an exceptional presentation experience throughout the customer's journey. By categorizing its product range into three stages based on the purchasing preferences of its customers, it aims to enrich the ambiance of homes, hotels, office buildings, and sports clubs as follows:

Stage 1 Products related to interior architecture, required during the construction phase. This includes bathroom products, flooring materials, lighting products, intelligent control devices, and built-in furniture, such as kitchen sets and wardrobes.

Stage 2 Product groups for interior product, utilized in various areas inside the house and building, including loose furniture and office furniture.

Stage 3 Product group for decoration and fitness equipment, offering additional selections for enhancing or decorating spaces. This includes fitness equipment, digital fitness technology, outdoor furniture, carpets, bedding, and decorative items.

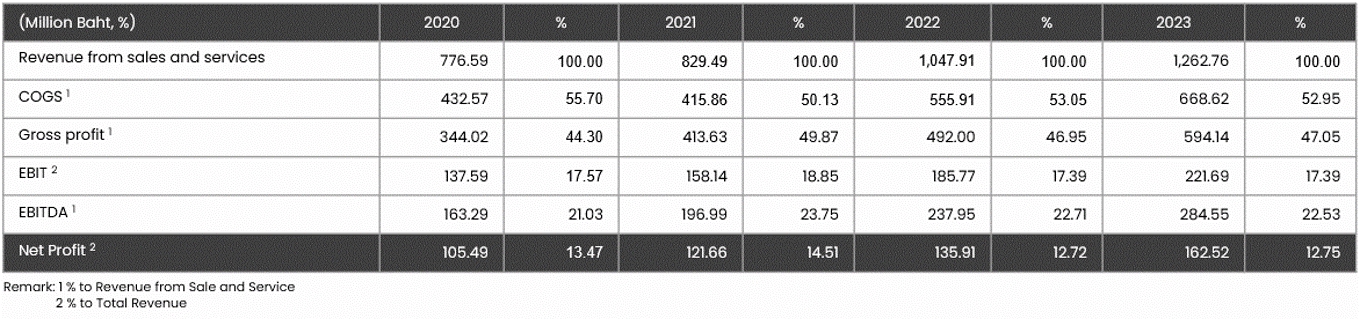

The revenue target is set to grow not less than 1,400 million baht, with an anticipated increase of approximately 15 - 18% from the year 2023. This growth is anticipated to come from the existing business by about 10 - 12%, and through the expansion via new brands such as Poltrona Frau, Frette, and Haworth, as well as the opening of new branches in 2024, contributing an additional 5 - 6%.

The revenue growth targets for the next 3-5 years are set at approximately 15 - 25%. This growth is planned to be achieved by introducing new luxury brand products, expanding the market through a broader range of designs and price points, and launching new products, including office furniture, through the opening of three new showrooms: a showroom in Phuket, Thonglor Soi 5 showroom, and Thonglor Soi 1 showroom. Additionally, the company has already employed advanced data analytics for enhancing marketing strategies and broadening its current customer base.

The Company classifies target customers into 2 main groups as follows:

- General Customer Group (Business to Customer: B2C)

This group includes customers who purchase products for personal use, prioritizing beautiful and unique design elements. These are typically high-income individuals who value lifestyle and taste.

- Business Customer Group (Business to Business: B2B)

This group consists of businesses involved in projects such as housing developments, condominiums, offices, hotels, hospitals or health facilities, and fitness centers, among others.

The company's strengths include:

- Acting as the official importer and distributor in Thailand for top-tier luxury brands from around the world.

- Offering a diverse range of products that encompass all aspects of creating dream spaces in various designs.

- Possessing showrooms in competitively advantageous locations.

- Having a strong customer base from over 25 years of operation in this business.

- Featuring a management team with vision, experience, and expertise in the luxury furniture business in Thailand.

The company's business does not experience seasonal fluctuations.

The Company serves as an importer and distributor for furniture, decorative products and fitness equipment from leading luxury brands. It is the sole official importer and distributor in Thailand of 16 brands such as Calligaris, Cassina, Christopher Guy, Dada, Frette, Galotti&Radice, Giorgetti, Limited Edition, Malerba, Molteni & C, Natuzzi Italia, Poltrona Frau, Robina, Rolf Benz, Sidea and Technogym etc. and is a distributor of general products of 13 other brands.

The company has a policy of paying dividends to shareholders at a rate of not less than 30% of the net profit from the company's separate financial statements after deducting corporate income tax and all types of reserves as prescribed by law and the company's regulations. However, the payment of such dividends may change depending on the economic conditions, the company's cash flow, the investment plans of the company and its subsidiaries (if any), and other appropriateness as deemed suitable by the company's board of directors.

Although the economy and the overall trend in the real estate industry are slowing down, the luxury real estate segment continues to grow. This is evident from the rapid growth of luxury real estate since 2022, which has continued into 2023, and is expected to persist into 2024. This includes developments such as housing estates, condominiums, or office buildings. These factors positively impact the company that offers products catering to the luxury living experience.